Cameroon cracks down on unlicensed fintechs, gives 3-month deadline to comply ⚠️

Cliquez ici pour lire en français

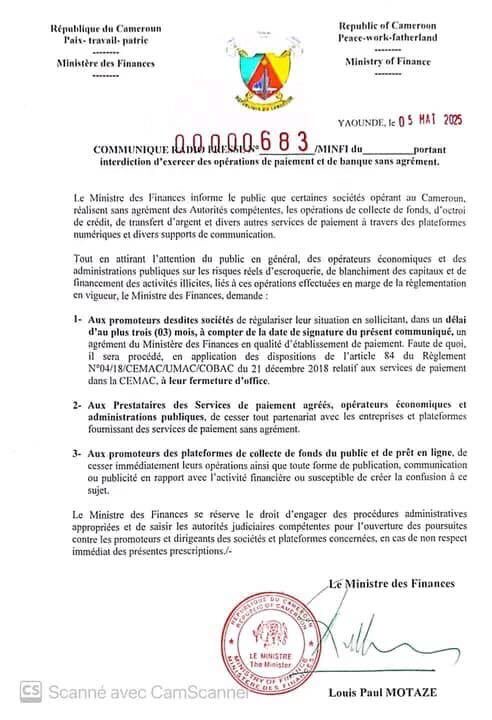

Cameroon’s Ministry of Finance is tightening the screws on fintech companies operating outside the law. In a public notice dated May 5, 2025, Finance Minister Louis Paul Motazé warned companies offering payment, money transfer, lending, and other digital financial services without official authorization that their time is running out.

These businesses now have three months to comply with existing regulations—or face forced shutdown.

A regulatory wake-up call for a risky landscape ⚖️

According to the ministry, several digital finance platforms are currently active in the country without proper licensing. Authorities view this as a serious concern due to the associated risks, including fraud, money laundering, and illicit financial flows.

The ministry is urging citizens, businesses, and public institutions to be cautious when dealing with these unauthorized services.

Three clear directives from the government 📋

In the statement, the Finance Minister outlined three key orders:

- Platform operators must apply for a license within three months of May 5. After that, their operations will be considered illegal and may be shut down automatically.

- All unlicensed payment service providers must cease operations immediately.

- Operators of online lending or crowdfunding platforms without approval must stop all activity and report themselves to the appropriate authorities.

These actions aim to eliminate confusion between regulated financial institutions and unlicensed fintechs, which often blur the lines for users.

Legal consequences are on the table ⚒️

The ministry also warned that it won’t hesitate to pursue administrative or legal action against violators. Law enforcement and the judiciary have been called upon to help enforce the measures.

This tougher stance comes at a time when digital financial services are booming, but often lack the legal frameworks needed to ensure consumer safety.

The statement refers to Regulation No. 04/18/CEMAC/UMAC/COBAC, issued on December 21, 2018, which governs payment services in the Central African Economic and Monetary Community (CEMAC). By reaffirming this regional legal framework, Cameroon’s government says it wants to protect users and strengthen trust in the country’s growing fintech sector.

💬 What do you think?

Have you ever used an online lending or money transfer platform without checking if it was legally authorized?

Share your thoughts in the comments—we’d love to hear from you! 😊

📱 Get our latest updates every day on WhatsApp, directly in the “Updates” tab by subscribing to our channel here ➡️ TechGriot WhatsApp Channel Link 😉